Victor Fredung: Tech savvy customers don't want to wait

Is identification and verification your company’s business? Or is it much wider?

Yes, it’s much wider than just identification. Our company focuses on all the different aspects of compliance.

Compliance actually involves KYC (Know Your Customer) which usually contains identity verification, but it also consists of the AML (Anti Money Laundering), KYB (Know Your Business), Transaction Monitoring and a lot of other sub-services.

Our company offers the majority of the services mentioned above as well as other added-value services to our clients.

So, you can help to build some inner processes for your clients’ businesses and not only for B2C clients, can’t you?

Yes, you’re right. Our clients are always businesses, but our clients can have their own clients that can be either individuals or businesses. The important case for a business is to verify users which predominantly are individuals.

As an example, if you want to open up a bank account, the company are obliged to verify that you are who you claim to be. Same for let’s say a PSP (Payment service provider) that wants to onboard a new merchant – same process here.

They also need to verify that merchant (KYB). We can also help them to actually find out who are the UBOs behind that company.

Who are the company´s founders, what is the registered address and all that kind of stuff. This actually helps with the onboarding procedure.

So you cooperate with banks, governments, police data...

Exactly. Those are our ideal clients, this is what we’re focusing on at the moment. Onboard as many bank and government clients as we possibly can. When it comes to cooperation, we are always looking for interesting challenges and we are in discussion with a lot of interesting parties at the moment.

Tell us please a little bit more about working with government or police, because I expect its a really complicated and interesting process.

Working with governments is a relatively new thing for us. I believe COVID made an impact at a governmental level and we are now starting to see more government initiatives on identity verification in general.

Another very interesting sector which is one of the obvious ones is the banking sector. This sector is very easy for us to demonstrate our value. Historically, looking back like 10-20 years the standard process has always been to walk in to a bank branch and verify yourself in person.

However, especially for the last 10 years banks have tried to digitalise as much of their process as they can and COVID has certainly been a huge boost for this as well due to all the lockdowns.

That is where we come in and offer them a not only cheaper option to verify their remote customers but also one of the quickest ways in the industry that takes only seconds to onboard customers.

What kind of other industries can use your solutions and your product?

Apart from banking clients, high risk industries are also good candidates for us, like gambling companies, FOREX companies or crypto businesses. These companies are used to identity verification procedures.

They’ve probably done it for the last ten or twenty years.

They are one of our biggest clients. We also provide a service to renters. If you’d like to rent an apartment when you’re going on a holiday you can select to verify your identity so that you build some trust with the landlord.

We also have a lot of financial clients using us (non-banking), the same for sectors such as insurance, telecom, rental and social media platforms.

What are the betting companies that you work with?

We do work with a lot of European ones such as – HeroGaming, Finnplay, Playtech, White Hat Gaming but we also have Penn National Gaming in the US which is one of the largest ones abroad.

As I understand it we are talking about the United States and Europe mostly. Right?

Not necessarily. It’s more like a background history. Maybe I should give some information about ourselves. First of all, myself and the other co-founder Shahid Hanif which is our CTO have been in the payment space for the past 12 years now.

We have operated our own payment gateway previously and we worked with a lot of different high-risk companies before such as gambling. This is probably also why it’s been quite easy for us to onboard these as well, since we have a good contact network.

What we saw back in the days was that a lot of our competitors now that existed back then had very out-dated technology.

I’m not sure how much you are aware of our competitors but previously we had tested the majority of the leading ones, however the problem was always consistent – the verification was too slow, it could take days and a lot of countries were actually excluded from being verified.

We wanted to create a process that first of all would give the customer the quickest and the most seamless verification journey there is and secondly, we also wanted it to be available worldwide.

To answer your question, we do have lots of clients in Europe and in the US, but also in Africa and Asia and the Middle East. What we find super interesting is that the APAC and EMEA regions are investing heavily in digitalization at the moment and we already have a very strong presence in those areas.

Primarily due to the fact that our system is very seasoned there already and that we have the capability to work with localized languages such as Arabic.

Let’s talk about your product a little bit more. Your solutions substitute a human operator. Is it correct?

Partly. We actually have two different solutions. For example, we have a hybrid version which consists of artificial intelligence and human operator – The Hybrid approach.

The second option that we offer to our clients is a fully automated solution. We provide it to enterprise clients exclusively, such as banks or governments, who will need implementations on premises or instant verification (< 1s response).

And what does your solution do?

We do a different thing. Instead of relying on data bases to double check your information, we’re checking your identity information in real time using ID Verification techniques and Facial Biometrics verification.

Our process is that you enable your webcam or the camera in the phone and then capture either by video or by photo a picture/video of your face and also of your ID document.

After you have captured the information that you wish to verify, we apply facial recognition technology to make sure you are the same person as on the ID document and we also perform a Liveness check to make sure you are a real human being.

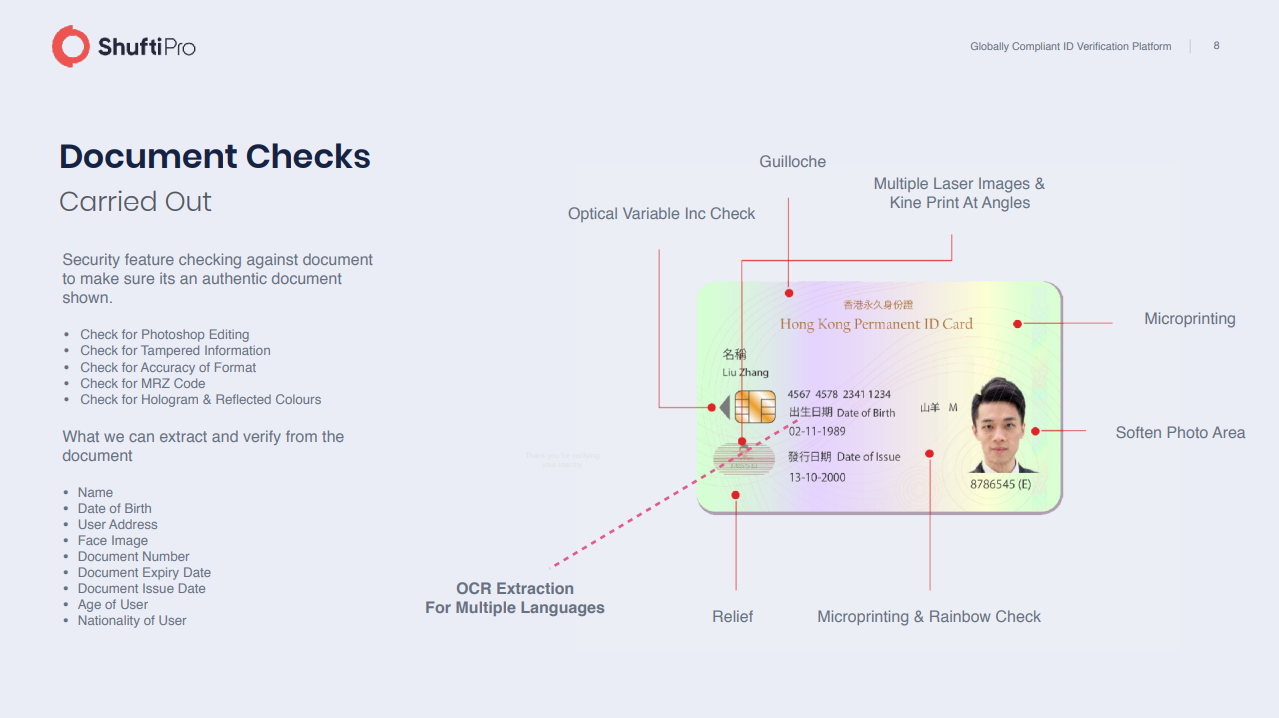

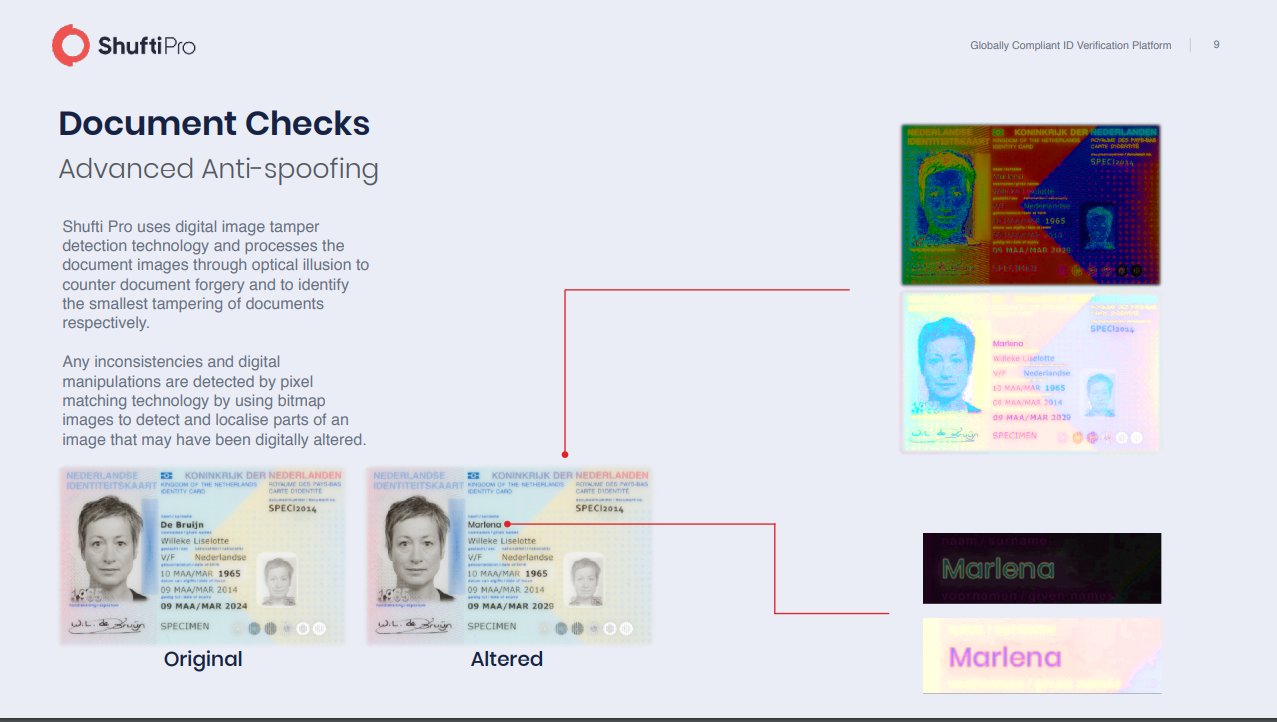

When we check your ID document, we make sure it is a genuine document that is being presented. We do this by analyzing the security features which are hundreds of different ones through Machine Learning Technology.

Finally, we also run it through our anti-spoofing technology to make sure nothing has actually been forged in your document.

In conclusion and very overly simplified that is how the technology works.

Many gambling companies uses similar procedure but with human operator who checks photos with ID or starts a video chat with a customer. How much money can your clients save because of your solution?

|  |

I don't have an exact percentage but first of all, yes, there are a lot of money to be saved by digitalizing verification process. Secondly there is also a lot of money to save in from actually giving the end-customers a quicker way for them to do what they set out to do.

What we have seen from surveys is that a lot of businesses are losing customer conversion due to slow handling times which also brings us to the conclusion that technology savvy customers simply don't want to wait.

When it comes to comparing our cost-effectiveness over our competitors, I would say we are fairly priced, especially since we offer unique selling points such as verifications in seconds, a complete compliance platform, customization abilities and a lot more.

In addition, we always aim to be transparent with our customers, we do not charge hidden support fees, annual fees or anything else which is not presented up-front.

Tell us please more about technical side.

I would say that it works in two different scenarios.

The first scenario is when a customer signs up to a gambling website and enters basic data. Usually gambling companies do light KYC immediately after a customer signs up. In this case a customer can play, but he will have a low withdrawal limit.

Then a company may provide one more verification, checking ID or some other documents.

The other scenario that we see is the more innovative approach. This is when a customer wants to sign up on the gambling websites, many companies launch our service immediately.

Instead of having the customer typing in all information manually, which is a very long process, you just show your ID document. We extract all the information from the document, and it’s uploaded through auto-population straight on the registration page automatically.

You don’t need to enter any information yourself. The entire process of verification takes seconds and companies do not later need to worry about verifying the customer since it has already been done.

Does it matter for your solution when a customer passes verification? During registration or before withdraw?

It’s always up to the client to decide the system itself. If we talk about the different ways of integration, we know that clients have different needs. With our system we have created a very easy way for clients to integrate.

API – If a client wants to collect all the information on their end and pass by API to us. iFrame – super quick integration that loads our verification journey within a client’s website.

- SDK’s – If a client has own mobile applications and wants to have the verification flow within.

- Onpremise – for clients that want to keep all the data within their own system architecture.

For most clients they simply use our Auto-code generator where they “Pick and Choose” which services they want and how they want the verification to be done, after that our system shows the client ready-made code which is easy to integrate.

Can your client choose to use a human operator working with your solution or isn't that possible?

Absolutely it's possible. When it comes to that it depends on the size of the client. Big clients usually have their own compliance team, they know what information they should collect. In this case our development team work alongside their compliance team. They say what exactly they need.

Smaller clients might not have much knowledge of what is essentially required. They might come to a new market from another jurisdiction.

We usually evaluate all the different regulatory requirements, what is needed to perform KYC and AML from a client’s perspective and help them to build their appropriate verification journey.

How heavy is your solution?

Not heavy at all, usually clients use our onsite verification. They send the request on what they like to do and how it should be performed. Then we send them a link, which is loaded within an iFrame on the website or application.

So, that part is not a big load on the client’s website.

We also have our SDK option for mobile applications, clients can integrate this directly into their own APP – this option is around a few megabytes, I guess.

You have a solution which can read all this IDs, documents etc. Is it expensive and hard to create?

It has certainly been very expensive and very hard to create, especially since we have developed everything in-house for our core products. Our systems are being used also partly as standalone technologies that other businesses license from us on a subscription basis.

How many people work in your company?

On average I would say we have 80 employees working full time. The reason why I say “On average” is because whenever we work on developing a new feature or a partial system, we need additional people, such as data scientists, developers etc.

We then hire them on a temporary basis instead of hiring 40 more guys as full-time employees. This approach helps us to reduce costs and spend our time wisely on different projects within the company.

Deportivo Táchira

Deportivo Táchira

Deportes Tolima

Deportes Tolima

Al-Okhdood

Al-Okhdood

Qadsia SC

Qadsia SC

Damac FC

Damac FC

Al-Shabab Riyadh

Al-Shabab Riyadh

Al-Taawoun

Al-Taawoun

Al-Feiha FC

Al-Feiha FC

Mainz-05

Mainz-05

hamburger

hamburger