Kelly’s Criterion in Sports Betting: What is it and How to Use it

The purpose of the betting strategy "Kelly's Criterion" is to determine the size of each upcoming bet for more reasonable management of your funds. It is believed that this method helps to protect the player from losing the entirety of their bankroll, as it does not provide a fixed bet size: the player independently assesses the probability of the event on which he plans to bet, and, based on this, calculates the optimal bid size under a special formula.

When to Use Kelly's Criterion in Betting?

Kelly's criterion is more suited for those who already have some experience of making bets with bookmakers, as the success of this strategy is determined, most of all, by the player’s ability to independently determine the probability of an event.

In fact, the strategy can be considered as a kind of competition between the player and the sportsbook, where the winner is the one who was able to more correctly determine the probability of the event.

The disadvantages of Kelly's criterion include the possibility of an incorrect assessment of the competition by the player. So, if a player overestimated the probability of an event, he will lose. If he underestimated it, then it will lead to a smaller winning spree.

How to Play by Kelly's Criterion: Calculation Formula and Examples

The Kelly criterion formula gives you the ability to calculate what the optimal bet size should be for a particular event. Again, this size will only be optimal if the sportsbook underestimated the probability of the event, and the player guessed it correctly.

To convert the odds into a percentage probability, you can simply divide 100 by the odds given. This must be done with decimal odds, and you can easily convert American odds into these by using an online odds converter.

For example, let's say the New Orleans Saints face the Tampa Bay Buccaneers and the odds of New Orleans winning are 1.40 (-250). To understand what the probability of a Saints victory is in a percentage, or at least what the sportsbook believes is correct, we predict according to the above formula:

(100/1.40 = 71.4%)

Thus, the sportsbook believes that Barcelona will win with a probability of 71%.

The player making the bet, believes that the probability of success of Barca is 60%. Therefore, the proposed quote is not overvalued, because the probability of outcome, according to the player, is lower than what is suggested by the bookmaker. That means it is not a bet for Kelly's test.

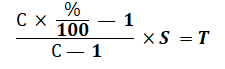

In order to correctly calculate the optimal size of the rate according to the Kelly criterion, we use the following formula:

- C -Sportsbook odds on the game

- % - This is the percentage of probability that you would assign to an outcome

- S - Size of the player's current bankroll

- T - This is the requiredstake amount

Let's Look at an Example

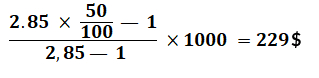

Manchester United host Tottenham at Old Trafford. For the probability of success for the "Red Devils" the sportsbook gives odds of 2.85 (+185), and therefore, is estimating the possible victory of MU at 35%.

The bettor, on the other hand, assumes that the probability of this event is 50%. It is still necessary to calculate the amount of bet that should be made on this event using the above formula. Let's say the size of our bankroll is $1000.

The original data for the formula:

- 2.85 -The sportsbook's odds

- 50 - The percentage of probability the player believes

- 1000 -Bankroll

T is the amount of bet that needs to be calculated.

Based on the calculations, we see that here we need to put 22.9% of the total size of the bankroll.

Summing up all of the above, again we remind you that this strategy of betting is more suitable for experienced players, as it is always difficult to determine the probability of an event without the help of the odds line.